north carolina sales tax rate on food

The state sales tax rate in North Carolina is 4750. 2 Food Sales and Use Tax Chart.

State Sales Tax Rates Sales Tax Institute

This page describes the taxability of.

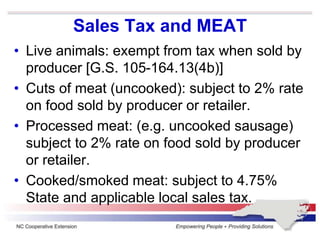

. A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. The sales tax rate on food is 2. With local taxes the total sales tax rate is between 6750 and 7500.

Outside Food Sales Representative. But when you add in local taxes they are quite close. Certain items have a 7-percent combined general rate and some items have a miscellaneous rate.

Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. Prescription Drugs are exempt from the North Carolina sales tax Counties and cities. This means that depending on your location within North Carolina the total tax you pay can be significantly higher than the 475 state sales tax.

Job in Boone - Watauga County - NC North Carolina - USA 28607. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. North Carolinas general state sales tax rate is 475 percent.

The transit and other local rates do not apply to qualifying. 2022 North Carolina Sales Tax By County North Carolina has 1012 cities counties and special districts that collect a local sales tax in addition to the North Carolina state sales tax. For example here is how much you would.

If you are looking for additional detail you may wish to utilize the Sales Tax Rate Databases which are provided. An initial comparison of sales taxes would makes it look like NC is more friendly when it comes to sales taxes. Items subject to the general rate are also subject to the.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. North Carolina has recent rate changes Fri Jan. 75 Sales and Use Tax Chart.

North Carolina Sales Tax Update

Sales Taxes In The United States Wikipedia

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Sales Tax Laws By State Ultimate Guide For Business Owners

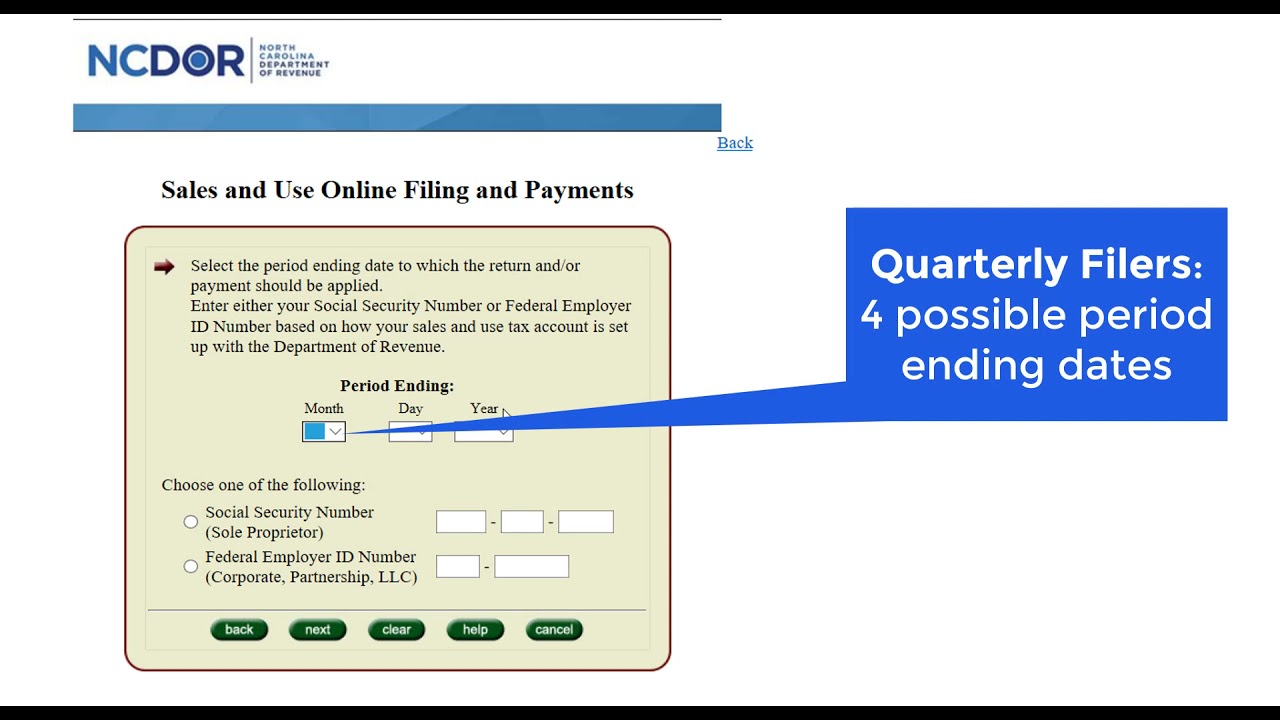

How To Register File Taxes Online In North Carolina

Online File Pay Sales And Use Tax Due In One County In Nc Youtube

States Without Sales Tax Article

Online Sales Tax Tips For Ecommerce 2022

Sales Tax On Grocery Items Taxjar

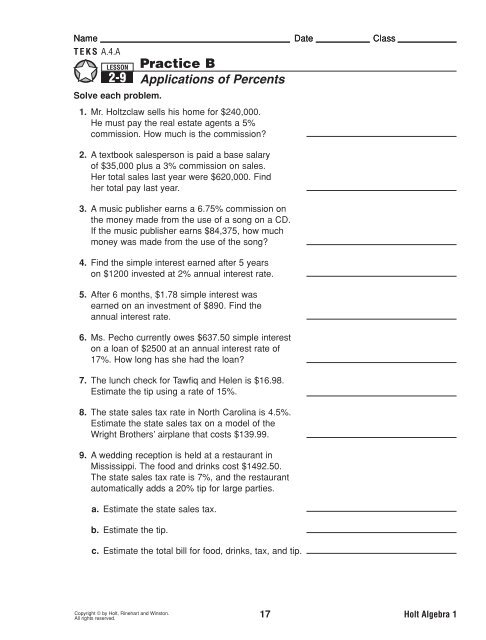

My Worksheet Maker The Best Worksheet Maker

County Advocacy Hub North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

New York State Tax Vs North Carolina State Tax Sapling

Important Sales Tax Issue For Residents Chatham County Nc

North Carolina Government Plans To Collect Taxes On Food Ticket Sales At Universities Elon News Network